Gio Ponti amid architecture, design and industry: from the Pirelli skyscraper to Domus, to furnishings reinterpreted through archival work

Branded residences: the market has tripled, so what are the opportunities?

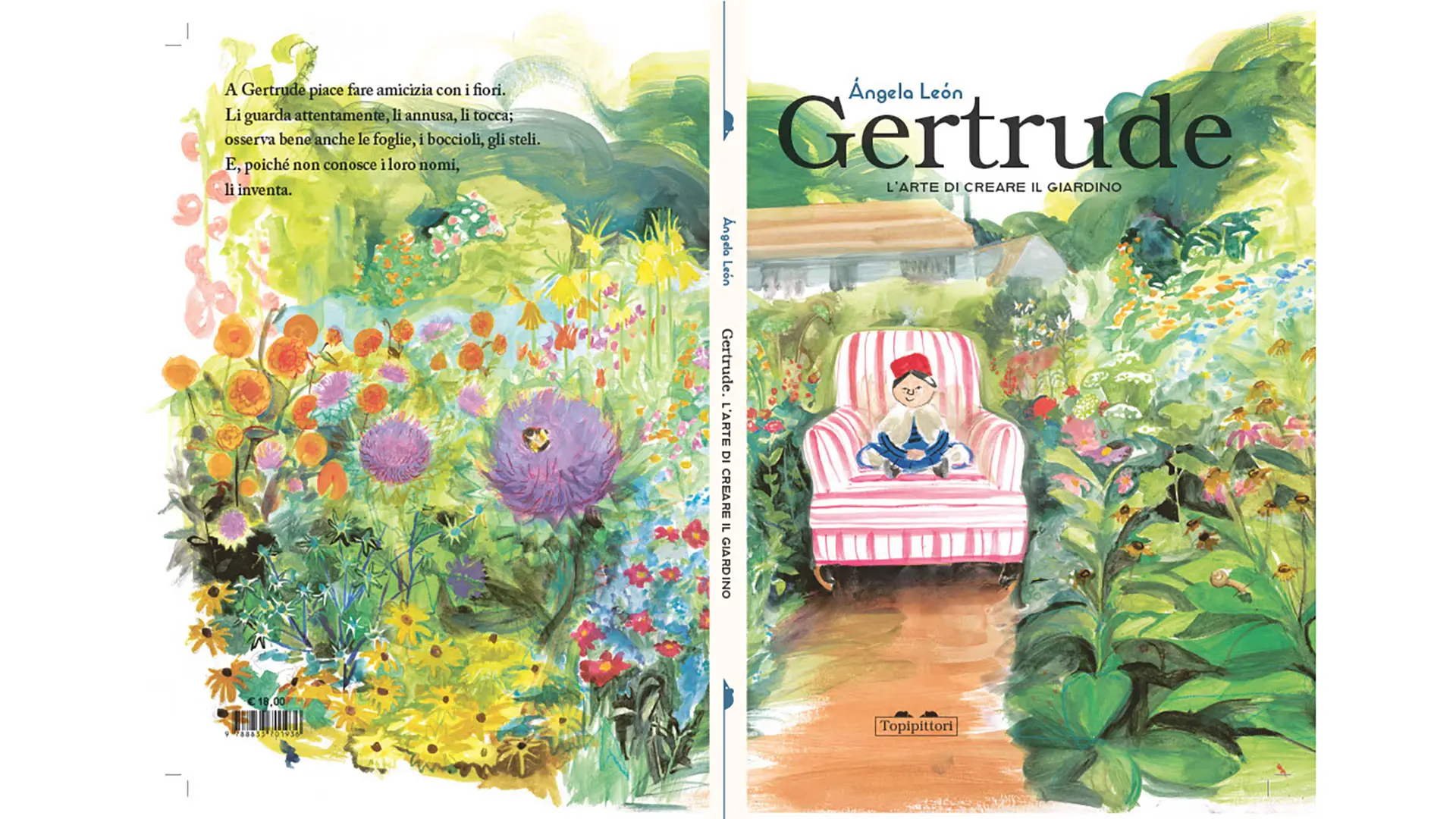

Gianfranco Ferré Residences, Ras Al-Khaimah, Emirati Arabi Uniti

The global race in figures: fashion, automotive and watchmaking join the hotel industry at the new frontier of exclusive living. Furniture brands also have a role to play

If it’s true that luxury residences are the barometer of consumption linked to global wealth and large assets, the Global Branded Residence Survey 2025 just published by Knight Frank, paints a very interesting picture, with the branded residence market continuing to climb at a sustained pace. According to the analysis carried out by the real estate agency, the number of projects of this kind rose from 159 in 2011 to the current 611, and is projected to reach 1,019 by 2023. Residential units are also following the same trend: from 27,000 in 2011 to over 162,000 within five years. This increase would appear to have become more marked from 2023 onwards, thanks to the growing demand for branded homes and the desire of companies within the sector to dominate this premium segment. Analysts expect these growth rates to slow as of 2028, but not to trigger a contraction because, as the report points out, the sector will continue to grow, driven by greater geographic diversification and the entry of new non-hotel brands.

Branded residences – the figures

As we said, geographical diversification. The survey reminds us that although the United States remain the world centre of branded residences, their relative weight is declining in favour of the Middle East, where the greatest leap forward has been seen: pipeline projects make up 26.7% of the total, compared with the current 15.9%. The United Arab Emirates and Saudia Arabia are leading the field, as we shall see.

Notwithstanding the great visibility of fashion and automative brands, the survey shows that 83% of global brand residences are still brand-aligned hotels. This figure is destined to fall slightly over the next few years, but only by a few percentage points. The large fashion brands are aiming to promote their heritage and offer this as an added value both for the businesses working on developing the projects and for those who will live in them.

Pipeline projects

So many projects have been announced, from one side of the globe to the other, that there is a danger of losing count.

Kerzner has announced plans for a One&Only resort and residences along the coasts of the island of Nacula, in western Fiji, and the launch of the Hudson Valley One&Only is also awaited, viewed as an alternative to the Hamptons and only 90 minutes from Manhattan and in collaboration with the Culinary Institute of America. Again in the States, the development of the new Mercedes-Benz tower is slated for 2027. In Europe, the former headquarters of the French Defence Department in Paris is being turned into one of the city’s first proper branded residential development, launching with The Maybourne Residences Saint-Germain. The opening, scheduled for 2027, will be signed by Pierre-Yves Rochon and Laura Gonzalez. In London, the most keenly-anticipated schemes include the completion of the development of Chelsea Barracks, with the last residences, curated by Qatari Diar, due to launch imminently. Knight Frank also flags up the fact that projects such as The Eatons in Belgravia (Native Land) and Cundy Street Quarter in Belgravia (Grosvenor and Lodha), as well as new residences close to South Kensington and Sloane Avenue (including one by Finchatton and Tribeca), due to be completed over the next five years. Furthermore, according to WWD, the first residences branded by the French interior design firm Liaigre will open in Florence in 2027, in collaboration with Capella Hotels and Resorts. Also, Nobu Hospitality is poised to debut in the Netherlands with the launch of the Nobu Residences Park Meadows Amsterdam and the Nobu Restaurant Amsterdam. Over on the other side of the world, the Nobu Residences project is due to be completed in 2027 in Saadiyat, Abu Dhabi.

Moving on to the Asia-Pacific area, the Marriott Residences have opened in Saigon, with Maison Delano and Radisson Blu due to inaugurate their branded residences in Seoul and Phnom Penh in 2026, followed by the Banyan Tree Residences in Manila and by Raffles in Jakarta the following year. The Porsche Design Tower in Bangkok will be completed by 2028.

Read also: How hospitality is changing, bringing innovations and opportunities for the sector

Non-hotel projects

Focusing on non-hotel brands in particular, the success of the great European fashion brands that have launched their branded residences at global level is plain to see. Etro Home Interiors has just unveiled Etro Residences Istanbul, its first branded real estate scheme, developed in partnership with RAMS Global. The ONIRO Group has also launched sales of the Gianfranco Ferré Residences in Ras Al-Khaimah, seen as one of the new up-and-coming United Arab Emirates destinations. Here too, Giorgio Armani has announced the launch of the Armani Beach Residences Ras Al Khaimah, which will include the first Armani branded villas in the world. When it comes to furnishing, this ranges from brands that collaborate on the interior design of residential projects to names that instead enter directly into the business. Lema has announced its participation in the prestigious Mandarin Oriental Residences Mayfair, situated on the corner of Hanover Square, one of London’s oldest and most prestigious addresses. For some time now, Visionnaire’s Real Estate division has been developing projects that apply the Maison’s sartorial approach to the residential sector, from Dubai to Phuket, by way of Malibu. Natuzzi Harmony Residences came into being last October, presented as the first residential scheme entirely conceived by a furnishing brand and situated on one of the Dubai Islands.

The expert’s analysis

“First and foremost I think it is important to define the difference between furniture companies and interior design firms as there is some clear cross-over,” says Louis Keighley, Head of Global Residential Development Consultancy at Savills, which is shortly due to publish its keenly-awaited annual report on branded residences. “Interior design brands have evidently already entered the sector and successfully. I think what is important to be conscious of, and this applies to all brand types looking to enter the sector, is brand following.” In theory, says the expert, any brand could attach its name to a residential project but what is important is how internationally recognised that brand is. It is the brand following, its network, its reach that adds value to a development. And what is challenging for a furniture brand is a lot of its product could be captured already by an interior design brand which inherently may have a stronger following. You also have to look at what a furniture brand can offer aside from furniture. “Non-hotel brands these days are leaning on a lifestyle, on experience, on building a community of like-minded people sharing like-minded experiences. Can a furniture brand compete in such a world where rivals are offering 1 of 20 cars as part of the purchase price or a track day experience or exclusive access to automotive events (c.f. automotive brands as an example)?” According to the expert, in order to break into the branded residences sector, they would need to have a strong enough following to warrant branding real estate and attracting enough buyers willing to pay a premium for the privilege: “I suppose one of the challenges for prospective furniture brands is that there is nothing stopping a purchaser buying a non-branded ultra luxury apartment and filling it with the furniture brand’s furniture. The furniture brand entering the sector would need to offer more – something to warrant the premium, something to drive demand.”

It is obvious that heritage and loyalty carry some weight. But equally, so does positioning, Keighley explains: “Luxury still makes up circa 70% of the completed schemes and more than 60% of the pipeline, so I think for a furniture brand it would need to be in the luxury space.” An alternative, he concludes, could be to break into the sector by collaborating with other hotel or non-hotel brands. In terms of rules of engagement, these vary significantly across the brands, but there would inevitably a licencing fee on each sale. Furthermore, “the furniture brand would likely need a white label operator to manage and operate the residences beyond that, this would be incredibly locationally specific.”

Savills’ next global annual report is scheduled for the end of October. Keighley believes that the growth in the sector over the last few years and the years to come speaks for itself: “There are now 790 completed schemes across the globe with over 855 schemes in the pipeline, expected to be delivered by 2032. That is more than 225 brands across 105+ countries.” One of the reasons we are seeing such extraordinary, sustained growth in branded residential is the product’s global reach and its ability to be developed over so many different geographies: “Put the right product, with the right brand in the right location and the project will be a tremendous success.” Certainly, the buyers of branded residential products are not necessarily bound to buying in one geography: “The brand is responsible for the opening up of the buyer pool and with global mobility more and more prevalent, this only helps bolster the branded residential model.” A particularly telling signal is the brands’ commitment, Keighley concludes: “We are not talking of an impressive pipeline for the next 1-2 years, but rather we have sight of significant growth in a 5+ year timeframe. For the brands, future market share is often more important than current market dynamics.”

Markets

Markets