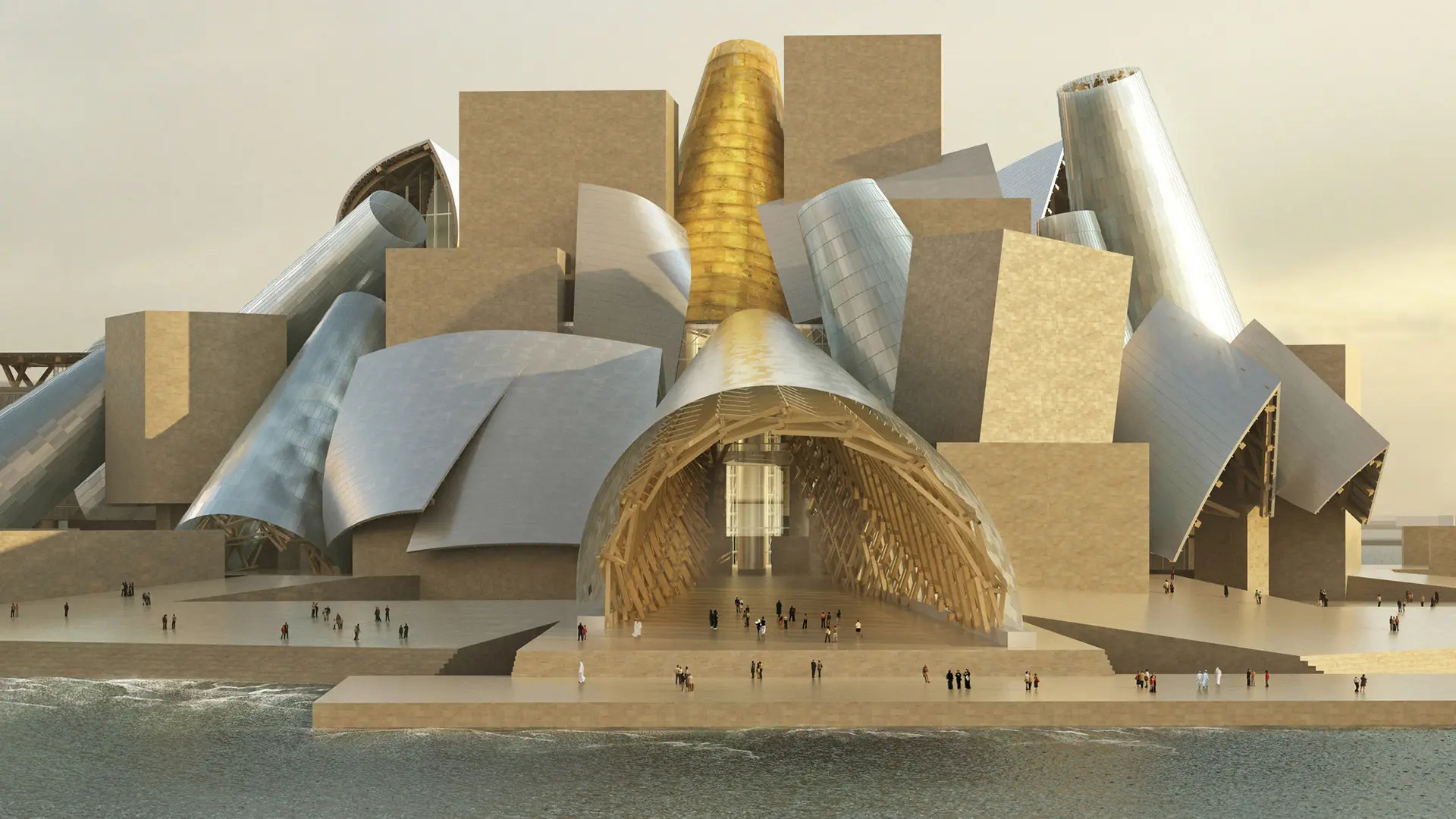

From BIG to David Chipperfield, Frank Gehry to Snøhetta: a world tour of the best buildings set to open in 2026

Photo Roberto Nickson

Capped throughout 2022 at €10,000, this allowance expired at the end of December. From 1 January it dropped to 8 thousand euro

From 1 January 2023 until the end of 2024, the deductible spending ceiling is halved.

Italy’s Budget Law confirmed an IRPEF deduction of 50 percent on purchases of furniture and large household appliances bought to furnish a property undergoing renovation. Take note: from 1 January, the deductible expenditure ceiling drops from the current €10,000 to €5,000. Deductions are divided into ten equal annual installments. This means that the rule provides for an IRPEF deduction over ten years, calculated on a maximum total amount of €10,000 for the year 2022 and €8,000 for the years 2023 and 2024.

What’s deductible?

The bonus covers new furniture and large appliances in a variety of energy classes (A for ovens, E for washers, dryers and dishwashers, F for refrigerators and freezers). Beds, closets, dressers, bookcases, desks, tables, chairs, nightstands, sofas, armchairs, and sideboards are all permissible furniture purchases. Mattresses and lighting fixtures are included too, but doors, floors, curtains and draperies and their fixtures and fittings are excluded. Transportation and assembly costs qualify, though as we shall see below, only certain payment methods are accepted.

How to access

The furniture bonus is paid out only if the expenditure is on furnishing a property on which renovation work benefitting from the 50 percent deduction has been carried out. For individual apartments or apartment buildings, such work ranges from routine and extraordinary maintenance – particularly, energy-saving work (such as replacing a boiler with a more energy efficient one) – to renovation and restoration. Note that energy-saving measures for which the 65 percent deduction has already been made, such as installing solar panels or replacing winter air conditioning systems, are ineligible.

The chronology is important too: to take advantage of the allowance, renovation or maintenance work must have commenced in the year prior to purchasing the furniture or appliances.

Last, the mobile bonus is non-transferable if the property is sold. There are, however, no limits on the number of times the benefit is available: anyone conducting renovation work on more than one property unit is entitled to access the benefit multiple times.

Payments

Payments should be made by bank transfer, debit or credit card. No payments by bank cheque, cash or other means are eligible. Payment by installment is permissible. Care must be taken to retain proof of payment (e.g., a bank transfer receipt) and invoices for goods purchased. Receipts are valid, provided that they show the purchaser’s tax ID number and indicate the “nature, quality, and quantity of goods purchased.”

Transportation payment and assembly expense documentation should be retained.

Markets

Markets