From urban geopolitics to the biopolitics of bodies, the 24th Triennale - inaugurated by Nobel Laureate in Economics Michael Spence, amongst others, and open to the public until 9th November - denounces the structural inequalities that mark contemporary lives, offering insights and solutions through the contributions of internationally renowned artists, architects, designers and scholars

Germany: the domestic market is driving furnishing sector recovery

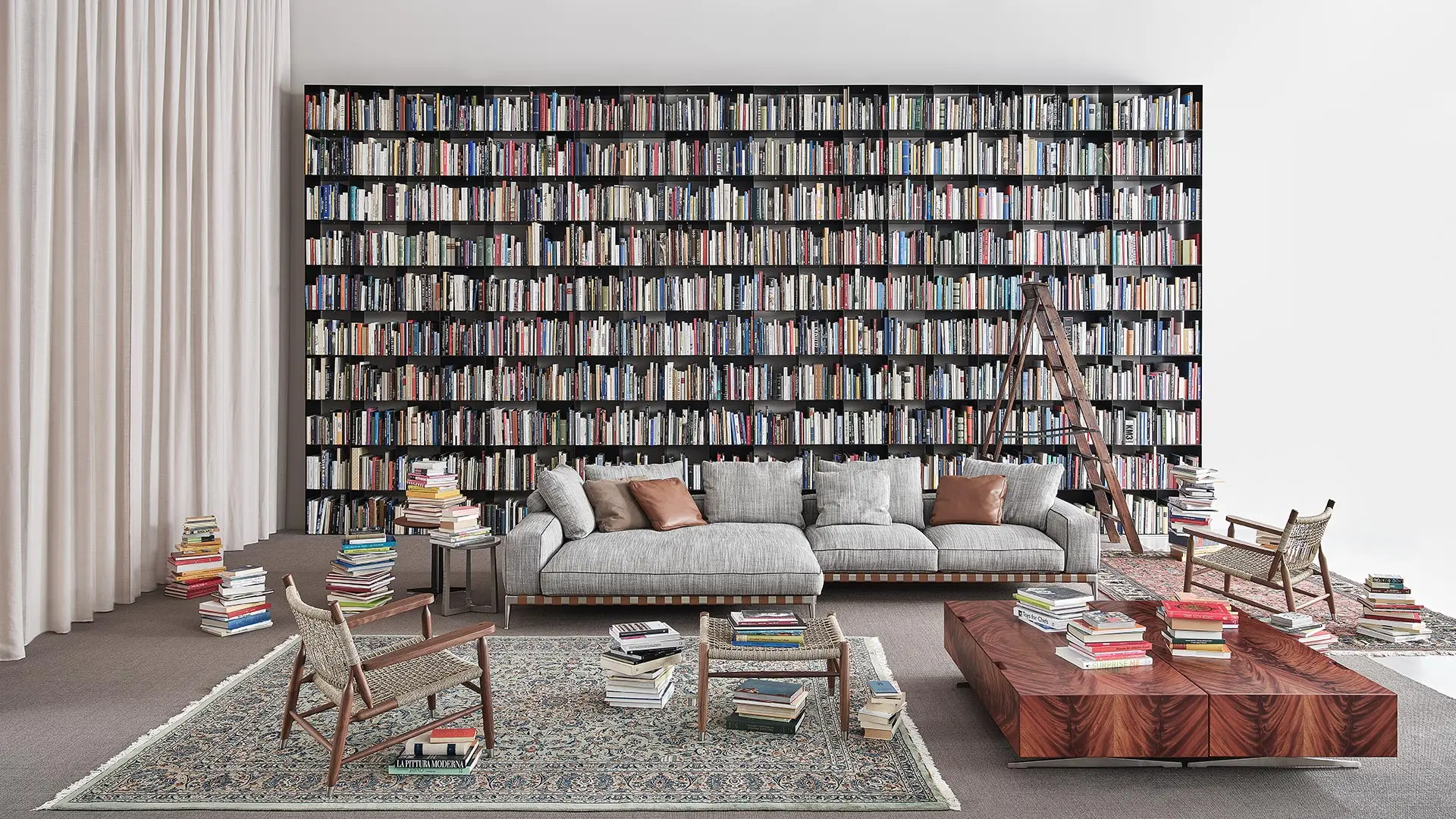

Photo courtesy Flexform

Increasingly on the look-out for comfort and functional spaces, Germany’s consumers are opting for flexible home solutions, in which the quality of kitchens and Made in Italy design meet head on

The German furnishing market is particularly prominent on the global scene for three simple reasons: domestic production, consumption and exports. especially within the European Union and to China. Germany boasts a huge range of furnishing manufacturers and an envy-making tradition in the kitchen world, which continues to register positive growth (+ 9% even in 2021). Despite the shock of the pandemic, which caused a 3.7% drop in 2020 compared with 2019, these assessments remain valid, also on the basis of the data of the German sectoral association VDM, which flagged up an almost 15% increase in exports in 2021, equal to 8.4 billion euros, and a 2% rise, equal to 17.5 billion euros, in domestic sales. The trade balance between Italy and Germany reveals a similar trend. Between 2019 and 2020, there was a 1.7% fall in Italian exports to Germany, offset by a 5.7% increase during the first ten months of 2021, equal to 869.013.000 euros (ICE data). The lack of raw materials, which made itself felt as of the second half of last year, is impacting sales, causing delivery delays as well as price hikes, but this applies to many goods and production sectors and therefore doesn’t indicate a crisis specific to the sector.

Hanne Willmann, photo courtesy

“The German furnishing market has gone through two intense years with many highs and lows,” says Hanne Willmann, designer and founder of Studio Hanne Willmann, a multidisciplinary practice based in Berlin, which focus on designs for the furnishing, lighting and tableware sector. “But, generally-speaking, specially where design brands are concerned, they have been successful years with growing profits. Particularly for brands with active distribution channels, both online and offline: it has proved to be a winning solution.” During the acute phase of the pandemic, the use of digital purchasing tools for furnishing products too was a boon for businesses bound up with the sector. “Many projects were created with the aid of digital technology, which enabled virtual meetings and content exchange to take place. The Web has helped to keep products accessible, both for consultation and for purchase, even though our segment centres on well-thought-through purchases, often guided by a professional, an architect or an interior decorator,” says Giuliano Galimberti, export sales director and member of the board of Flexform.

Hanne Willmann, Fungi and Portao, Favius, ph. Fabian Frinzel

The pandemic and the lockdowns have upended the habits of many citizens of the world and highlighted certain latent attitudes in some segments of society. “People saved money during the pandemic and have finally been able to spend on and invest in their homes,” adds Hanne Willmann. “There’s been strong demand for particularly versatile furnishing for an easy fusion of home office and living room: these sorts of solution have formed the core of the furniture market over the last few years.” Now German consumers, aware of how homes can be turned into all round living spaces, are demanding an even greater sense of comfort, as well as an assurance of extremely high products that will guarantee comfort, durability and respect for the environment. The VDM data confirm this: sales of upholstereds rose 13%, those of mattresses 3.5%. “The principal need is to feel at ease,” continued Mr Galimberti. “Germans have responded to the forced change of lifestyle and the various restrictions on mobility by investing in their comfort, redesigning their own spaces and their own homes. Consumers these days are looking for a generalised feeling of wellbeing. We have witnessed a reinterpretation of living spaces, homes that become places of work, of leisure, where entertainment can be enjoyed to the full and, in some cases, gyms too, without having to compromise on total comfort for all who live there. Looks are undoubtedly the main element of this quest.” One such example, particularly popular among German consumers, is Flexform’s Gregory sofa, designed by Antonio Citterio, characterised by its intriguing combination of metal base and leather straps.

Giuliano Galimberti, photo courtesy Flexform

Willmann puts sustainability at the forefront as regards the trends that will drive the next few years: “It will be the main goal of the German furniture market. However, the fusion of contract and private life is becoming increasingly pronounced and we’re seeing a great many solutions in this segment.” This is further confirmed by the forecasts contained in the Mordor Intelligence German Home Furniture Report 2022-2027: furniture made from natural materials and presenting an innovative design will be one of the driving trends in German furniture. With regard to the company founded by the Galimberti brothers, Berlin was one of the first markets to give the green light for the internationalisation of Flexform and respond positively to Made in Italy. “One of the most admirable things about the German world is its ability to explore and carry out research beyond its own borders, which accounts for its ongoing admiration for Italian manufacturers. Made in Italy’s perceived value is extremely high. Many Italian design brands enjoy excellent sales performance on the German market. These results are made possible by a skilled network of distributors, specialist shops that have become ambassadors for our system. Over the last few years in particular, Flexform has seen significantly increased appreciation from both professionals and end users. In addition to the recent flagship store in Munich, we are planning to open new monobrand spaces in other German cities, geared to offering consumers a real brand experience at the point of sale,” concluded Galimberti.